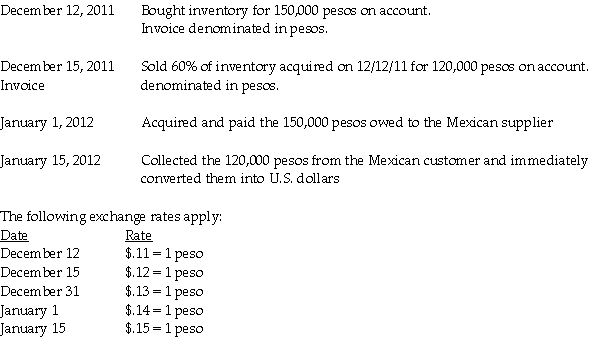

Johnson Corporation (a U.S.company)began operations on December 1, 2010, when the owner contributed $100,000 of his own money to establish the business.Johnson then had the following import and export transactions with unaffiliated Mexican companies:

Required:

Required:

1.What were Sales in the income statement for the year ended December 31, 2011?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31, 2011?

4.What is the Inventory balance in the balance sheet at December 31, 2011?

Definitions:

Kidnapping

The unlawful taking and carrying away of a person against their will, often to hold for ransom or as part of another crime.

Crisis Counselors

Professionals who specialize in providing support and guidance to individuals in acute emotional distress, particularly during crises or traumatic events.

Supervision

The act of overseeing, directing, or managing individuals or processes to ensure compliance, progress, and quality of work.

Grief and Loss

Emotional suffering and mourning resulting from the death of a loved one or the loss of something significant in one's life.

Q6: In reference to the Uniform Probate Code,

Q12: On December 18, 2011, Wabbit Corporation (a

Q13: Ohio Corporation is being liquidated under Chapter

Q15: On July 1, 2010, Parslow Corporation acquired

Q17: In reference to the determination of goodwill

Q19: When considering an acquisition, which of the

Q19: If the BLS counted persons that are

Q29: If the intercompany sale was an upstream

Q35: Required:<br>1.Prepare a schedule to allocate income to

Q164: Which of the following statements is true