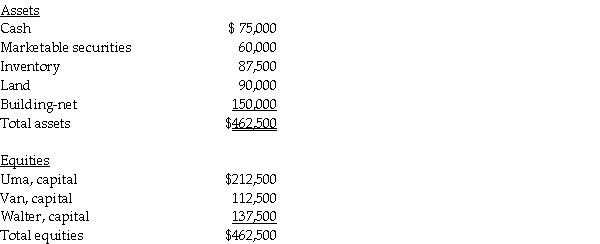

A summary balance sheet for the Uma, Van, and Walter partnership on December 31, 2011 is shown below.Partners Uma, Van, and Walter allocate profit and loss in their respective ratios of 4:5:7.The partnership agreed to pay Walter $227,500 for his partnership interest upon his retirement from the partnership on January 1, 2012.Any payments exceeding Walter's capital balance are treated as a bonus from partners Uma and Van.

Required:

Required:

Prepare the journal entry to reflect Walter's retirement.

Definitions:

Scheffé Test

Statistical procedure used to control familywise error when conducting all possible simple and complex comparisons in a set of data.

Complex Comparisons

Analytical comparisons involving more than two groups.

Power Distance

A cultural dimension that describes the extent to which individuals in a society accept and expect that power is distributed unequally.

Culture

Culture represents the shared values, beliefs, norms, and practices that shape the social behavior and interactions within a group, organization, or society.

Q8: On December 31, 2011, Maria Corporation has

Q16: Plower Corporation acquired all of the outstanding

Q22: Prepare journal entries to record the following

Q24: On November 14, 2011, Scuby Company (a

Q28: What type of fund should be used

Q33: On November 1, 2010, Athom Corporation purchased

Q34: The exchange rates between the Australian dollar

Q37: For each of the following events or

Q83: In a centrally planned economy,the government decides

Q140: Refer to Scenario 1-1.Using marginal analysis terminology,what