Use the following information to answer the question(s) below.

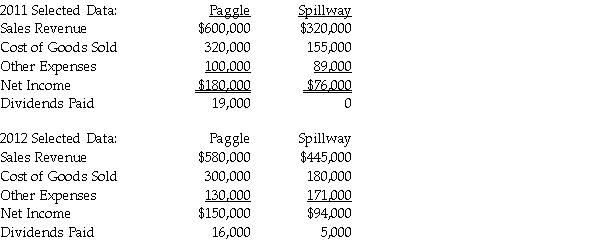

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value.At the time of purchase,the book value and fair value of Spillway's net assets were equal.The two companies report the following information for 2011 and 2012.

During 2011,one company sold inventory to the other company for $50,000 which cost the transferor $40,000.As of the end of 2011,30% of the inventory was unsold.In 2012,the remaining inventory was resold outside the consolidated entity.

-If the intercompany sale was an upstream sale,the total amount of consolidated cost of goods sold for 2012 will be

Definitions:

Strike Price

The Strike Price is the predetermined price at which the holder of an option can buy (in a call option) or sell (in a put option) the underlying asset.

Black-Scholes Option Pricing Model

A mathematical model used to price European call and put options by calculating the option's expected payoff at expiration.

Strike Price

The specified price at which the holder of an option contract can buy (in case of a call option) or sell (in case of a put option) the underlying security.

Black-Scholes Option Pricing Model

A mathematical formula used to determine the theoretical price of European put and call options, taking into account factors like the stock price, strike price, time to expiration, and volatility.

Q6: A foreign entity is a subsidiary of

Q9: Suppose that the labor movement has a

Q11: In preparing the consolidated financial statements for

Q17: On December 31, 2011, Potter Corporation has

Q17: GAAP requires that segment information be reported<br>A)

Q19: Meric Corporation (a U.S.company)began operations on January

Q20: Phlora purchased its 100% ownership in Speshal

Q20: Snodberry Catering has five operating segments, as

Q34: Pepper Company paid $2,500,000 for the net

Q240: Which of the following cause the unemployment