Use the following information to answer the question(s) below.

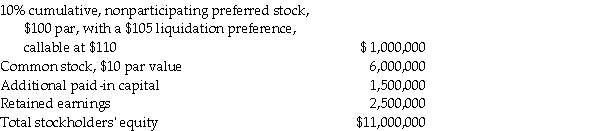

On January 1,2011,Pardy Corporation acquired a 70% interest in the common stock of Salter Corporation for $7,000,000 when Salter's stockholders' equity was as follows:

There were no preferred dividends in arrears on January 1,2011.There are no book value/fair value differentials.

There were no preferred dividends in arrears on January 1,2011.There are no book value/fair value differentials.

-Salter has a 2011 net loss of $200,000.No dividends are declared or paid in 2011.What is the change in Pardy's Investment in Salter for the year ending December 31,2011?

Definitions:

Q5: On January 1, 2011, Pilgrim Imaging purchased

Q6: Willborough County had the following transactions in

Q8: The following are transactions for the city

Q15: When a cash flow hedge is appropriate,

Q20: The 2011 unrealized gain from the intercompany

Q26: The City's municipal golf course had the

Q26: Warren Peace passed away, with his will

Q27: Governmental fund financial statements are prepared on

Q29: Which statement below is incorrect with respect

Q238: An unemployment insurance program has which of