Use the following information to answer the question(s) below.

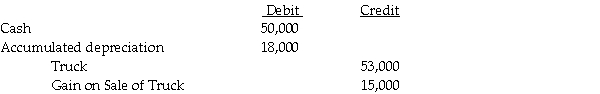

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-In the eliminating/adjusting entries on consolidation working papers for 2012,the Truck account was

Definitions:

Coalitions Form

The process by which groups come together to form alliances, often to achieve a common goal or address a shared concern.

Properties

Characteristics, attributes, or traits that define an object, situation, or entity, making it distinguishable from others.

Coalition

An alliance among individuals or groups, especially during a negotiation or in politics, to achieve a common goal.

Bedfellows

Unlikely or surprising partners united by common interests or objectives.

Q2: For 2010 and 2011, Sabil Corporation earned

Q10: Goodwill arising from a business combination is<br>A)

Q16: Pecan Incorporated acquired 80% of the voting

Q18: For an operating segment to be considered

Q22: The acquisition of treasury stock by a

Q23: Under the parent company theory, what amount

Q26: A cash distribution plan for the Sammi,

Q31: The 2011 consolidated income statement showed noncontrolling

Q32: Anthony Company declared and paid $20,000 of

Q36: Which condition must be met for fresh-start