Use the following information to answer the question(s) below.

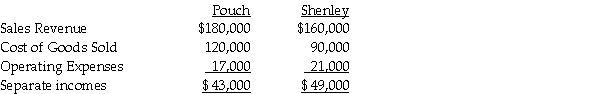

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2012, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2012, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2012, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

-Swamp Co., a 55%-owned subsidiary of Pond Inc., made the following entry to record a sale of merchandise to Pond:  All Swamp sales are at 125% of cost.One-fourth of this merchandise remained in the Pond's inventory at year-end.A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount of

All Swamp sales are at 125% of cost.One-fourth of this merchandise remained in the Pond's inventory at year-end.A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount of

Definitions:

Borrowing Need

The necessity for an individual or organization to raise funds through loans or debt issuance to finance its operations or investments.

Costs Of Placing An Order

Expenses associated with ordering inventory, including administrative costs, shipping, handling, and procurement costs, critical in managing inventory levels.

Shortage Cost

Costs incurred from not having enough inventory or resources to meet demand, including lost sales and dissatisfied customers.

Cumulative Cash Surplus

The total amount of cash that exceeds the initial investment or expenses over a period.

Q1: Which of the following is a true

Q3: If the number of unemployed workers is

Q9: Paik Corporation owns 80% of Acdol Corporation

Q20: Noncontrolling interest share for Badrack is<br>A) $9,000.<br>B)

Q25: On January 2, 2011, Power Incorporated paid

Q33: A foreign subsidiary's accounts receivable balance should

Q69: The base period for CPI calculations is

Q98: If inflation is completely anticipated,<br>A)no one loses

Q120: Suppose that at the beginning of a

Q231: Refer to Table 9-5.Consider the following values