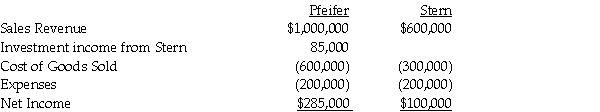

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal.At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets.Separate company income statements for Pfeifer and Stern for the year ended December 31, 2011 are summarized as follows:

During 2010, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31, 2010.During 2011, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31, 2011 inventory.

During 2010, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31, 2010.During 2011, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31, 2011 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2011.

Definitions:

Contribution Margin

The amount remaining from sales revenue after variable costs are deducted, used to cover fixed costs and generate profit.

Differential Revenue

Differential revenue is the difference in revenue between two alternative decisions or periods, highlighting the potential increase or decrease in income resulting from a chosen action.

Condensed Income Statement

A simplified income statement that presents only key revenue and expense items, ignoring detailed breakdowns.

Discontinuance

The act of ending or terminating a business operation or the production of a product line.

Q2: Paine Corporation owns 90% of Achan Corporation,

Q7: Assume there are routine inventory sales between

Q10: Pomograte Corporation bought 75% of Sycamore Company's

Q14: What is the threshold for reporting a

Q16: No constructive gain or loss arises from

Q33: On November 1, 2010, Athom Corporation purchased

Q37: Charin Corporation, a U.S.corporation, imports and exports

Q108: A student who just graduated from college

Q196: The purchase by a household in China

Q246: Which of the following policies would reduce