PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1, 2010, for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

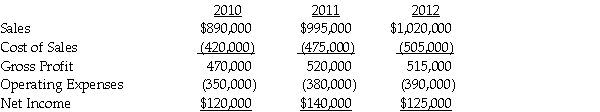

PreBuild's separate income (excluding investment income from Shoding)was $870,000, $830,000 and $960,000 in 2010, 2011 and 2012, respectively.PreBuild sold inventory to Shoding during 2010 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2011.At the end of 2011, PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2012.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2010, 2011, and 2012.

Definitions:

High-Paying Occupations

Jobs that offer wages significantly above the average for all occupations.

Domestic Output

The aggregate monetary value of goods and services created within a country's borders throughout a specified period.

Discrimination Coefficient

A measure used to quantify the extent to which prices are adjusted based on customer characteristics in markets where price discrimination occurs.

African Americans

A racial or ethnic group in the United States characterized by an ancestry linked to Africa, particularly sub-Saharan Africa.

Q1: A highly-effective hedge of an existing asset

Q5: Anna and Bess share partnership profits and

Q15: Petrol Company acquired an 90% interest in

Q16: Pecan Incorporated acquired 80% of the voting

Q32: Paradise Corporation owns 100% of Aldred Corporation,

Q37: Assuming a present value factor of 1

Q71: The United States has _ social insurance

Q104: In the first half of 2011,automobile sales

Q177: The CPI in 2010 was 218,while the

Q193: The increased generosity of unemployment insurance programs