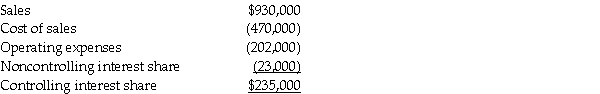

Pastern Industries has an 80% ownership stake in Sascon Incorporated.At the time of purchase, the book value of Sascon's assets and liabilities were equal to the fair value.The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets.At the end of 2011, they issued the following consolidated income statement:

Shortly after the statements were issued, Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31, 2011.

Shortly after the statements were issued, Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31, 2011.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2011.

Definitions:

Weak

Lacking strength, effectiveness, or force in physical terms, arguments, or characters.

Critical Thinking

The intellectually disciplined process of actively and skillfully conceptualizing, applying, analyzing, synthesizing, and/or evaluating information.

Purposeful Judgments

Decisions or evaluations made with a specific intention or goal in mind, often reflecting a deliberate choice.

Well-Reasoned Judgments

Judgments that are logically sound and based on careful consideration and evaluation of all relevant information.

Q5: On January 1, 2010, Platt Corporation purchased

Q7: Pony acquired Spur Corporation's assets and liabilities

Q9: Several years ago, Pilot International purchased 70%

Q16: Assume the functional currency of a foreign

Q20: In a limited partnership, a general partner<br>A)

Q22: Peter Corporation owns a 70% interest in

Q29: Barnes Company entered into a forward contract

Q201: What is outlet bias?<br>A)the tendency for households

Q277: Discouraged workers are<br>A)workers who have a part

Q291: What are menu costs?<br>A)the full list of