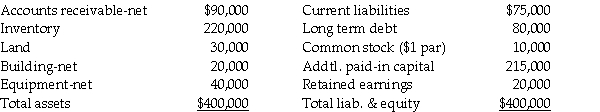

Bigga Corporation purchased the net assets of Petit, Inc.on January 2, 2011 for $380,000 cash and also paid $15,000 in direct acquisition costs.Petit, Inc.was dissolved on the date of the acquisition.Petit's balance sheet on January 2, 2011 was as follows:

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35,000 and $35,000, respectively.Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35,000 and $35,000, respectively.Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Definitions:

Capitalized Interest

Interest expenditures included in the cost of a self-constructed asset

Construction Loans

Short-term loans provided to finance the building or renovation of a property, typically converted into a long-term loan after the construction is completed.

Labor and Material

Refers to the total cost of the work force (labor) and the materials used in the production of goods or the provision of services.

Transportation Costs

Expenses incurred in moving goods or materials from one location to another, including shipping fees, freight, and logistics services.

Q2: Pied Imperial Corporation acquired a 90% interest

Q2: On January 2, 2011, PBL Enterprises purchased

Q5: On July 1, 2011, Polliwog Incorporated paid

Q12: If the intercompany sale mentioned above was

Q17: At the beginning of 2011, Parling Food

Q128: The Bureau of Economic Analysis divides it's

Q135: The labor force participation rates of men

Q176: Even though it is generally true that

Q184: Refer to Table 9-9.Suppose that the data

Q193: The increased generosity of unemployment insurance programs