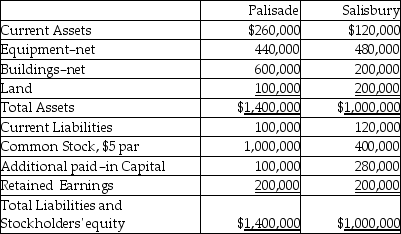

The balance sheets of Palisade Company and Salisbury Corporation were as follows on December 31, 2010:

On January 1, 2011 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares, and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

On January 1, 2011 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares, and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1, 2011.

Definitions:

Q7: You agree to lend $1,000 for one

Q19: Ackroyd's noncontrolling interest share for 2011 is<br>A)

Q24: Nominal GDP is another term for<br>A)inflation-adjusted GDP.<br>B)real

Q25: Plateau Incorporated bought 60% of the common

Q26: Onoly Corporation (a U.S.manufacturer)sold parts to its

Q32: By offering training to workers whose firms

Q93: The drawback to calculating real GDP using

Q125: Recent estimates put the size of the

Q151: "Household production" refers to<br>A)the manufacturing of durable

Q292: Which of the following cause the unemployment