Marsha Cook owns Marsha's Pie Co. On January 2, 2010, the company purchased an oven for $325,000. The manufacturer of the oven estimates that the oven will last 12 years or bake 600,000 pies, with a residual value of $25,000.

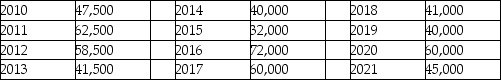

The following is a schedule of the pies that the company will produce:

Calculate the accumulated depreciation and book value as of December 31, 2016, using the units of production method.

Calculate the accumulated depreciation and book value as of December 31, 2016, using the units of production method.

Definitions:

EBIT

Earnings before interest and taxes, a measure of a firm's profitability that excludes interest and income tax expenses.

Financial Leverage

The use of borrowed funds to increase the potential return on investment, amplifying both potential gains and losses.

Returns to Shareholders

The gains earned by shareholders on their investments in a corporation, typically in the form of dividends and stock price appreciation.

Q60: On January 1, 2012, Peterson Corporation issued

Q110: Bertha's Pharmacy shows cash sales of $2,500

Q112: Martin Motors purchased a machine that will

Q134: The Allowance to Adjust Investment to Market

Q134: The direct-write off method:<br>A) may overstate accounts

Q135: Ben's Burgers paid $300,000 for a piece

Q142: If a U.S. Company has a foreign

Q153: On July 1, 2012, Bobby's Building Corp.

Q175: On January 1, 2012, Rex Corporation purchased

Q188: If the current ratio is 3.2, and