Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

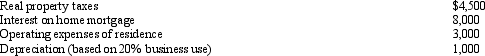

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business.Gross income from the business is $13,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business?

What is Rocky's net income from the repair business?

Definitions:

Incorporation Theory

A principle in United States law that ensures states cannot enact laws that take away the constitutional rights of American citizens that are enshrined in the Bill of Rights.

Bill of Rights

The first ten amendments to the United States Constitution, guaranteeing specific freedoms and protections to American citizens.

Incorporation Doctrine

The legal concept that the Bill of Rights applies to state governments as well as the federal government through the Fourteenth Amendment's Due Process Clause.

Gitlow v. New York

A landmark Supreme Court case in 1925 that ruled the Fourteenth Amendment to the U.S. Constitution extended the First Amendment's provisions protecting free speech and free press to the states.

Q9: "Tradeoffs" are a strategy used in competitive

Q11: What does it mean that the "conflict

Q11: Some research states that great turmoil has

Q26: The key date for calculating cost recovery

Q29: If you work to reach your own

Q42: Theresa sued her former employer for age,race,and

Q59: Last year,Green Corporation incurred the following expenditures

Q111: On July 10,2011,Ariff places in service a

Q111: The Perfection Tax Service gives employees $12.50

Q140: A taxpayer who claims the standard deduction