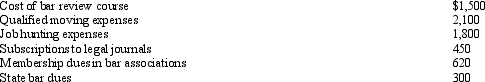

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Definitions:

Null Hypothesis

A statistical proposition that asserts the absence of a difference or effect, typically to be tested against an alternative hypothesis suggesting a significant effect or relationship.

Null Hypothesis

A default hypothesis that there is no significant difference or effect, used as a basis for statistical testing.

Weight Loss Strategy

A plan or approach designed to achieve a reduction in body weight, often involving changes in diet and exercise routines.

Critical Value

A point on the scale of a test statistic beyond which we reject the null hypothesis; it marks the threshold for statistical significance.

Q13: Legal expenses incurred in connection with rental

Q16: Henry entertains several of his key clients

Q21: Tara purchased a machine for $40,000 to

Q21: Which statement is incorrect?<br>A) Net assets, net

Q42: Christopher just purchased an automobile for $40,000

Q65: If an item such as property taxes

Q82: Myra's classification of those who work for

Q100: Iris collected $100,000 on her deceased husband's

Q101: Meg's employer carries insurance on its employees

Q107: Only certain expenses associated with the production