Essay

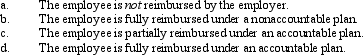

Discuss the 2%-of-AGI floor and the 50% cutback limitation in connection with various employee expenses under the following arrangements:

Definitions:

Related Questions

Q2: In establishing reporting requirements,the Corporations Act distinguishes

Q14: Which term defines a 'financial report intended

Q22: Because anger is such a negative emotion,you

Q23: Which of the following is NOT an

Q45: In 2011,Morley,a single taxpayer,had an AGI of

Q46: Barbara was injured in an automobile accident.She

Q59: Last year,Green Corporation incurred the following expenditures

Q103: On July 17,2011,Kevin places in service a

Q135: Taylor,a cash basis architect,rents the building in

Q140: Brenda invested in the following stocks and