Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

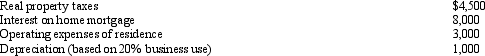

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business.Gross income from the business is $13,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business?

What is Rocky's net income from the repair business?

Definitions:

Internal Explanations

The justifications or reasons for phenomena, actions, or decisions that originate from within an individual or organization.

Attribution Theory

A concept in psychology that explains how individuals infer causes for their own and others' behaviors.

Behaviour

The actions or reactions of an individual or group in response to external or internal stimuli.

Workplace

A location or virtual space where individuals are employed and engage in tasks related to their job responsibilities.

Q10: White Company acquires a new machine (seven-year

Q11: In the Framework's definition of expenses:<br>A) there

Q27: An entity has decided to commit itself

Q34: Compare the FASB definition of revenue and

Q34: A participant has an adjusted basis of

Q48: Which of the following is correct?<br>A) A

Q70: Tired of renting,Dr.Smith buys the academic robes

Q92: Rex,a cash basis calendar year taxpayer,runs a

Q97: The only asset Bill purchased during 2011

Q140: A taxpayer who claims the standard deduction