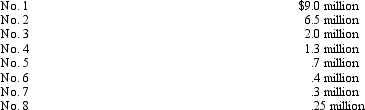

The salaries of the top eight executives of Lemon,Inc.are as follows:

Definitions:

Maximum Deductible

The highest amount that can be deducted from taxable income, often referring to specific expenses or types of deductions.

Out of Pocket Expense

Expenses that are paid directly by an individual and not reimbursed, often related to healthcare, business, or personal costs.

Self-Employment Tax

The tax covering Social Security and Medicare for individuals who work for themselves, essentially the self-employed version of FICA taxes.

Schedule C

A section of the IRS Form 1040 that allows self-employed individuals to report their business income and expenses.

Q7: Samuel,age 53,has a traditional deductible IRA with

Q13: Using borrowed funds from a mortgage on

Q16: The Crown Trust distributed one-half of its

Q36: Like a limited liability company,the fiduciary is

Q43: In the case of a below-market loan

Q57: Gull Corporation was undergoing reorganization under the

Q71: In 2011,Jimmy,a cash basis taxpayer,was offered $3,000,000

Q73: Priscella pursued a hobby of making bedspreads

Q97: The $25 limitation on the deductibility of

Q102: For 2011,Stuart has a short-term capital loss,a