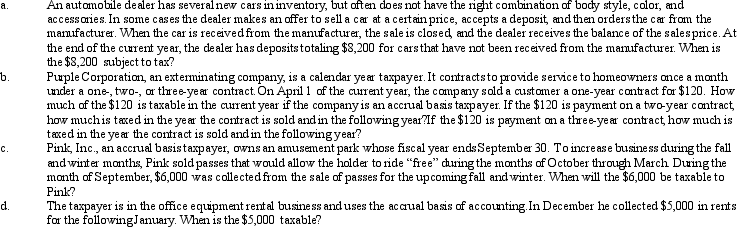

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Changing Conditions

Variations or alterations in the environment, circumstances, or requirements that affect a situation or activity.

SWOT Analysis

A strategic planning tool used to identify Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning.

Core Competencies

refer to the unique strengths and abilities that a company or individual possesses, which give them a competitive advantage in the market.

Special Strengths

Unique abilities or talents that distinguish an individual or entity from others; often contributing significantly to success.

Q5: During 2011,Marcus had the following capital gains

Q18: Calvin's property was taken by the State

Q46: The U.S.has death tax conventions (i.e.,treaties)with most

Q51: The Code defines a "simple trust" as

Q54: A cash basis taxpayer can deduct the

Q61: In 2011,Mary had the following items: <img

Q76: The first step in computing an estate's

Q87: Turner,a successful executive,is negotiating a compensation

Q92: George and Erin are divorced,and George is

Q99: Which of the following is a typical