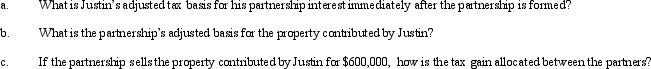

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability,which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain,which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Bubbles

In economics, a market condition characterized by rapid escalation of asset prices followed by a contraction.

Marginal Revenue

The extra revenue generated by the sale of an additional unit of a product or service.

Monopolist

An individual or business entity that is the sole provider of a particular good or service, enabling control over market prices.

Inverse Demand Function

A mathematical function that expresses price as a function of quantity demanded, illustrating how price varies with changes in demand.

Q13: Tara and Robert formed the TR Partnership

Q35: In order to encourage the development of

Q50: A state sales/use tax is designed to

Q53: Acquisition indebtedness consists of the unpaid amounts

Q57: A shareholder bought 2,000 shares of Zee

Q58: An exempt organization owns a building for

Q65: Barry and Irv form Swift Corporation.Barry transfers

Q82: The Internal Revenue Code of 1986 was

Q136: Are all exempt organizations eligible to be

Q146: Pat is a 40% member of the