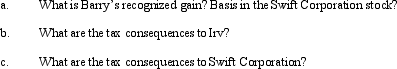

Barry and Irv form Swift Corporation.Barry transfers cash of $100,000 and equipment (basis of $300,000 and fair market value of $400,000)for 50% of Swift's stock.Irv transfers land and building (basis of $510,000 and fair market value of $450,000)and agrees to manage the business for one year for the other 50% of Swift's stock.The value of Irv's services for one year is $50,000.

Definitions:

Private Lands

Areas of land owned by individuals or companies rather than by the government or public entities.

National Parks

Protected areas intended for the preservation of natural beauty, biodiversity, and cultural heritage, accessible for public enjoyment and education.

Human Activities

Actions and behaviors undertaken by humans that impact the natural world and each other, ranging from industrial production to leisure activities.

Funding

The act of providing financial resources, typically money, or other values such as effort or time, to support a program, project, individual, or organization.

Q16: Charlotte sold her unincorporated business for $500,000

Q26: Charmine,a single taxpayer with no dependents,has already

Q41: Blue Corporation distributes property to its sole

Q54: Josh has a 25% capital and profits

Q59: Juan,not a dealer in real property,sold land

Q84: Andrew owns 100% of the stock of

Q107: Mike is a self-employed TV technician.He is

Q123: Jackson sells qualifying small business stock for

Q134: Five years ago,Eleanor transferred property she had

Q154: Marcie is a 40% member of the