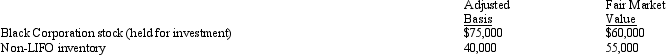

In the current year,Verdigris Corporation (with E & P of $250,000) made the following property distributions to its shareholders (all corporations) :  Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

Definitions:

Leadership Making

The process of developing leadership capabilities within individuals and organizations, emphasizing the growth and evolution of effective leadership.

Agreeableness

A personality trait characterized by kindness, cooperation, warmth, and consideration for others.

Subordinate Benefit

The advantages or improvements experienced by employees or lower-ranking individuals within an organization as a result of certain policies, actions, or leadership practices.

High LMX

A strong, positive, and high-quality relationship between a leader and their subordinate, characterized by trust and mutual respect.

Q26: Regulations are arranged in the same sequence

Q34: Syndication costs arise when partnership interests are

Q41: There is no Federal income tax assessed

Q66: Julio exchanges property,basis of $100,000 and fair

Q69: On December 31,2010,Erica Sumners owns one share

Q89: Which tax provision does not apply to

Q93: Almond Corporation,a calendar year C corporation,had taxable

Q100: When property is contributed to a partnership

Q113: You are a 60% owner of an

Q138: The governing document of a limited liability