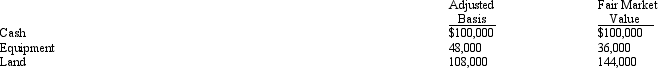

Kathleen transferred the following assets to Mockingbird Corporation.  In exchange,Kathleen received 40% of Mockingbird Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Kathleen received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Mockingbird Corporation five years ago.

In exchange,Kathleen received 40% of Mockingbird Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Kathleen received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Mockingbird Corporation five years ago.

Definitions:

Parol Evidence

A rule that prevents parties to a written contract from presenting extrinsic evidence of terms that would contradict, modify, or vary the contractual terms written in the document.

UCC Statute of Frauds

A section of the Uniform Commercial Code that requires certain types of contracts, such as those for the sale of goods over a certain value, to be in writing to be enforceable.

Specially Manufactured Goods

Items that are produced to a buyer's personal specifications, which are not suitable for sale to others in the ordinary course of the seller's business.

Promissory Estoppel

A legal doctrine that prevents a party from withdrawing a promise made to another party if the latter has relied upon that promise to their detriment.

Q1: Crystal contributes land to the newly formed

Q10: Harold lent $200,000 to a close personal

Q12: Corporate distributions are presumed to be paid

Q23: A U.S.Tax Court decision carries less weight

Q37: In the current year,the POD Partnership received

Q51: Which of the following is (are)a taxable

Q54: Josh has a 25% capital and profits

Q57: On December 31,2011,Peregrine Corporation,an accrual method,calendar year

Q93: At the beginning of the current year,Doug

Q114: In early 2010,Wilma paid $56,000 for an