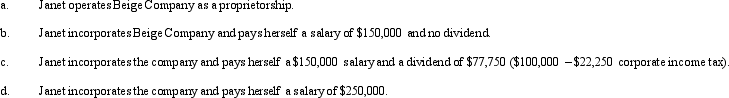

Beige Company has approximately $250,000 in net income in 2011 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations.)

Definitions:

Economic Factor

Any factor that relates to the economy and has an influence on financial matters, such as employment rates, inflation, or consumer spending patterns.

Extra Supports

Methods or resources provided to individuals or groups to help them overcome challenges and succeed.

Community

A group of people living in the same place or having a particular characteristic in common, often sharing a sense of belonging or mutual support.

Motivated

Having a strong desire or willingness to do something or achieve a particular goal.

Q1: Jose receives a nontaxable distribution of stock

Q5: On April 16,2010,Blue Corporation purchased 15% of

Q62: Robin,who is a head of household and

Q78: Albert,age 57,leased a house for one year

Q78: Tara incorporates her sole proprietorship,transferring it to

Q87: Sandy has the following results of netting

Q88: Spiro was leasing an apartment from Grey,Inc.Grey

Q105: In 2011,the AMT exemption for a single

Q114: The tax treatment of corporate distributions at

Q130: For a stock redemption to qualify for