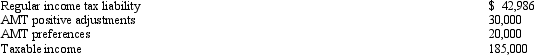

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2011.  Calculate his AMT for 2011.

Calculate his AMT for 2011.

Definitions:

Organ Donation

The process of giving an organ or a part of an organ for the purpose of transplantation into another person.

Federal Law

Refers to the body of law created by the national government of a country, which applies to all states and citizens within that country.

Muslim Faith

A monotheistic religion founded on the teachings of Prophet Muhammad, emphasizing the worship of one God, Allah, and adherence to the Quran.

Hospice Caregivers

Individuals or professionals providing compassionate care and support for terminally ill patients, focusing on comfort and quality of life.

Q2: Donald owns a 60% interest in a

Q5: Unless a taxpayer is disabled,the tax credit

Q8: The maximum child tax credit under current

Q9: As to the AMT,a C corporation has

Q30: Summer Corporation's business is international in scope

Q42: In determining the amount of the AMT

Q45: Rosa,the sole shareholder of Robin Corporation,contributes land

Q49: Because current U.S.corporate income tax rates are

Q51: Individuals can deduct from active or portfolio

Q54: Walter sold land (a capital asset)to an