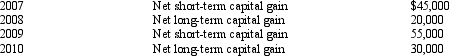

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2011.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 20117.

Compute the amount of Bear's capital loss carryover to 20117.

Definitions:

Market Revolution

A period of economic transformation in the United States during the early 19th century, characterized by a shift from subsistence farming to large-scale agriculture, and the emergence of regional and national markets.

Skilled Craftsmen

Individuals who possess expert knowledge and proficiency in a particular craft or trade, often requiring manual dexterity and the use of tools.

Economic Freedom

The ability of individuals and businesses to engage in economic activities without undue government intervention, leading to greater prosperity and societal well-being.

Chicago

A major city in the United States, known for its significant contributions to art, culture, and economy as well as its diverse population.

Q32: A cash basis taxpayer sold investment land

Q34: What is a deathbed gift and what

Q35: If the regular income tax deduction for

Q43: Use the following selected data to calculate

Q47: At the beginning of the year,Elsie's basis

Q51: Which of the following statements about the

Q60: The rules used to determine the taxability

Q67: Under what circumstances will a distribution by

Q78: For regular income tax purposes,Yolanda,who is single,is

Q83: Kathleen transferred the following assets to Mockingbird