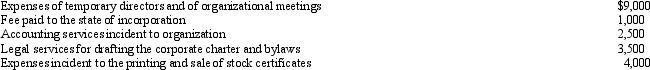

Emerald Corporation,a calendar year C corporation,was formed and began operations on July 1,2011.The following expenses were incurred during the first tax year (July 1 through December 31,2011) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2011?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2011?

Definitions:

Deregulation

The process of removing government regulations, oversight, and involvement from an industry.

Subsidization

Financial assistance granted by the government or an organization to support an economic sector, business, or consumer, making the goods or services more affordable.

Capitalist States

Countries where economic systems are based on private ownership and the free market determines allocation of resources.

Authoritarian States

Nations where political power is concentrated in a single authority, with limited personal freedoms.

Q26: Discuss the treatment of losses from involuntary

Q30: George Judson is the sole shareholder and

Q40: In 2010,Jenny had a $12,000 net short-term

Q44: To ensure the desired tax treatment,parties contemplating

Q51: In 2011,Alvin exercised an incentive stock option

Q52: A taxpayer can obtain a jury trial

Q68: Julian,Berta,and Maria own 400 shares,400 shares,and 200

Q71: Ostrich,a C corporation,has a net short-term capital

Q73: The DEF Partnership had three equal partners

Q109: Opaque Company had machinery destroyed by a