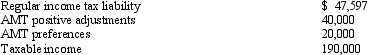

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2011.

Calculate her AMT exemption for 2011.

Definitions:

Master Budget

The total of all individual budgets within an organization, projecting all major financial activities over a period.

Flexible Budget

An adaptable budget configured to change with differing levels of activity or volume.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of several different investments.

Variable Costs

Variable costs are expenses that change in proportion to the activity of a business, such as sales volumes.

Q19: Jason (now 37 years old)owns a collection

Q24: An individual taxpayer received a valuable antique

Q40: Katherine,the sole shareholder of Purple Corporation,a calendar

Q44: Explain the difference between tax avoidance and

Q59: Jenny spends 32 hours a week,50 weeks

Q65: Barry and Irv form Swift Corporation.Barry transfers

Q76: Harold is a head of household,has $27,000

Q100: Nathan owns Activity A,which produces income,and Activity

Q104: Thistle Corporation declares a nontaxable dividend payable

Q108: Generally,corporations with no taxable income must file