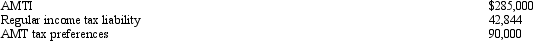

Caroline and Clint are married,have no dependents,and file a joint return in 2011.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Personality Disorder

A mental disorder defined by persistent unhealthy patterns in behavior, thought processes, and personal feelings that unfold in various situations and significantly diverge from what is considered normal by the individual's cultural standards.

Antisocial

Behavior that goes against social norms, often harming others or lacking consideration for their well-being.

Impulsive

Acting or done without forethought, often based on immediate desires or emotions.

Callous

Showing or having an insensitive and cruel disregard for others.

Q12: In the current year,Rich has a $40,000

Q31: Several years ago,Tom purchased a structure for

Q41: There is no Federal income tax assessed

Q46: An eligible taxpayer may elect to receive

Q57: If an installment sale contract does not

Q62: Allen transfers marketable securities with an adjusted

Q73: Bear Corporation has a net short-term capital

Q82: Jessica,a cash basis individual,is a 60% shareholder

Q91: The tax benefits resulting from tax credits

Q100: To compute the holding period,start counting on