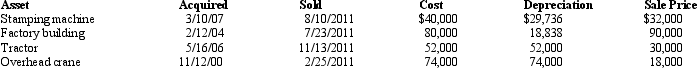

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Definitions:

Q8: The maximum child tax credit under current

Q14: A C corporation is required to annualize

Q30: Summer Corporation's business is international in scope

Q38: List the taxpayers that are subject to

Q40: Katherine,the sole shareholder of Purple Corporation,a calendar

Q48: Green Company,in the renovation of its building,incurs

Q52: The child tax credit is based on

Q68: Which of the following correctly describes the

Q85: Under what circumstance is there recognition of

Q92: Nora acquired passive activity A several years