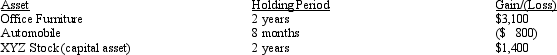

The following assets in Jack's business were sold in 2011:  The office furniture had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The XYZ stock was purchased for $1,800 and sold for $3,200.In 2011 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

The office furniture had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The XYZ stock was purchased for $1,800 and sold for $3,200.In 2011 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Social Comparison

The tendency to compare and judge one’s abilities, achievements, and behaviors in relation to others.

Self-esteem

An individual's subjective evaluation of their own worth and capabilities.

Social Status

The position or rank of a person or group within the social hierarchy, often influenced by wealth, occupation, or family heritage.

Self-concept

An individual's perception of themselves, encompassing beliefs, feelings, and knowledge about one's abilities, appearance, and social worth.

Q3: Why is it generally undesirable to pass

Q19: Nancy had an accident while skiing on

Q29: "Collectibles" held long-term and sold at a

Q57: Explain the purpose of the tax credit

Q64: In 2011,Louise incurs circulation expenses of $210,000

Q85: Felix sells his personal residence to Julio

Q88: Gail exchanges passive Activity A,which has suspended

Q89: Yellow,Inc.sold a forklift on April 12,2011,for $3,000

Q109: If the tentative AMT is less than

Q140: The tax law does not require that