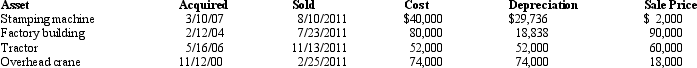

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Definitions:

Years

Units of time representing a period of twelve months or 365 days, traditionally used as a measure of time passing.

Startup Stage

The early phases in the life cycle of a business where it is developing its product, market, and operations, often characterized by uncertainty and high risk.

Nascent Stage

The early development phase of a project or company, often characterized by high uncertainty and risk.

Entrepreneurial Transition

The process or phase where an entrepreneur or business undergoes significant change, often towards growth or diversification.

Q3: Omar acquires used 7-year personal property for

Q25: In 2011,Kathy sold an apartment building to

Q26: Jerry's at-risk amount in a passive activity

Q34: Tom and George form Swan Corporation with

Q40: Katherine,the sole shareholder of Purple Corporation,a calendar

Q48: For purposes of computing the deduction for

Q49: On January 5,2011,Bill sells his principal residence

Q52: Melissa,age 58,marries Arnold,age 50,on June 1,2011.Melissa decides

Q59: During the year,Purple Corporation (a U.S.Corporation)has U.S.-source

Q122: For Federal income tax purposes,there never has