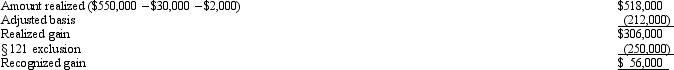

On January 5,2011,Bill sells his principal residence with an adjusted basis of $212,000 for $550,000.He has owned and occupied the residence for 18 years.He pays $30,000 in commissions and $2,000 in legal fees in connection with the sale.One month before the sale,Bill painted the exterior of the house at a cost of $5,000 and repaired various items at a cost of $3,000.On October 15,2011,Bill purchases a new home for $525,000.On November 15,2012,he pays $25,000 for completion of a new room on the house,and on January 14,2013,he pays $15,000 for the construction of a pool.What is the Bill's recognized gain on the sale of his old principal residence and what is the basis for the new residence?

Definitions:

Francis Bacon

An English philosopher, statesman, scientist, and author who is known for developing the scientific method and contributing to the early development of science.

The Structure of Scientific Revolutions

A book by Thomas S. Kuhn that introduced the concept of paradigm shifts in the scientific community, explaining how scientific progress is not linear but consists of periodic, revolutionary changes.

Scientific Problems

Issues or questions that arise within the context of scientific research, requiring investigation and experimentation to solve or understand.

Initially Identified

The first recognition or discovery of something or someone in a particular context.

Q7: Julius,a married taxpayer,makes gifts to each of

Q10: Gold Corporation,Silver Corporation,and Copper Corporation are equal

Q30: Dr.Stone incorporated her medical practice and elected

Q46: Joyce,an attorney,earns $100,000 from her law practice

Q49: Generally,deductions for additions to reserves for estimated

Q53: Currently,the Federal income tax is more progressive

Q74: Mel gives a parcel of land to

Q90: Distinguish between a direct involuntary conversion and

Q92: During the current year,Vijay,a self-employed individual,paid the

Q149: Taxes levied by both states and the