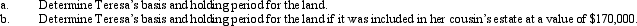

Teresa inherits land from her first cousin,Drew,in 2011.Drew's adjusted basis in the land (purchased in September 2008)was $200,000 and it was included in his estate at a value of $270,000.

Definitions:

Supporting Purpose

Aims to provide evidence or reasons that bolster the main intent or argument.

Detailed List

A comprehensive enumeration of items that includes specific information about each item.

Writing Report

The process of creating a structured document that conveys information, findings, or results related to a specific topic or investigation.

Work Plan

A detailed outline of the tasks, timelines, and resources required to complete a project or achieve an objective.

Q29: Taxpayer acquired a personal residence ten years

Q37: Ken has a $40,000 loss from an

Q46: A characteristic of the fraud penalties is:<br>A)

Q54: Indicate which,if any,statement is incorrect.State income taxes:<br>A)

Q65: During the current year,Waterthrush Company had operating

Q66: Eric makes an installment sale of a

Q71: Bob and Sally are married,file a joint

Q91: Which of the following assets held by

Q106: Taxes levied by all states include:<br>A) Liquor

Q132: Nonrecaptured § 1231 losses from the six