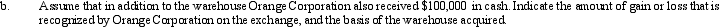

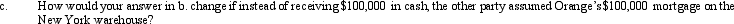

a.Orange Corporation exchanges a warehouse located in New York (adjusted basis of $480,000)for a warehouse located in New Jersey (adjusted basis of $450,000; fair market value of $440,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Definitions:

Polycentric

In the context of international business, polycentric refers to a strategy or approach where a company adapts its products, practices, and policies to fit the local cultures and conditions of the countries in which it operates.

Transnational Company

A corporation that operates in multiple countries, transcending national boundaries with integrated global strategies.

Global Company

A business entity that operates in multiple countries around the world, transcending national boundaries and markets.

Vision

A clear, inspiring long-term desired change resulting from an organization's work, guiding its strategic planning and decision making.

Q23: In 2011,T Corporation changed its tax year

Q24: Justin owns 1,000 shares of Oriole Corporation

Q28: Which of the following factors should be

Q44: What is the easiest way for a

Q66: Frank,a widower,had a serious stroke and is

Q66: Akeem,who does not itemize,incurred a net operating

Q69: Sean purchased vacant land in 2005 that

Q96: Theresa and Oliver,married filing jointly,and both over

Q116: Kay had percentage depletion of $119,000 for

Q122: Lee was the holder of a patent