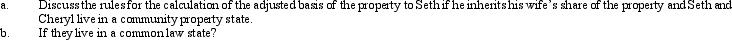

Seth and Cheryl,husband and wife,own property jointly.The property has an adjusted basis of $25,000 and a fair market value of $30,000.

Definitions:

Undercapitalization

The lack of funds to operate a business normally.

Small-Business Failure

A situation where a small-sized business is unable to continue operation due to financial, managerial, or market-related problems.

Q14: A C corporation is required to annualize

Q20: In the current year,Crow Corporation,a closely held

Q32: Caroline sells a rental house for $320,000

Q37: Refundable tax credits include the:<br>A) Foreign tax

Q67: A calendar year,cash basis corporation began business

Q72: A business machine purchased April 10,2010,for $62,000

Q75: Qualified research and experimentation expenditures are not

Q83: Judy owns a 20% interest in a

Q92: Negative AMT adjustments for the current year

Q117: On January 3,1997,White Corporation acquired an office