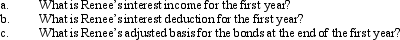

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

New System

A term referring to the introduction or implementation of a novel set of procedures, technologies, or methodologies in an organizational setting.

Discount Rate

The interest rate used to discount future cash flows to their present value, often reflecting the riskiness of the investment or the cost of capital.

Total Cost Approach

A method in supply chain management that considers all costs associated with acquiring, transporting, and holding goods alongside their purchase price.

Discount Factor(s)

A multiplier used in discounting or present value calculations that reflects the time value of money.

Q5: A calendar year taxpayer files his 2010

Q9: Qualified rehabilitation expenditures include the cost of

Q19: Molly has generated general business credits over

Q23: A taxpayer who meets the age requirement

Q26: Tina,whose MAGI is $50,000,paid $3,000 of interest

Q43: During 2011,Ralph made the following contributions to

Q44: The Yellow Equipment Company,an accrual basis C

Q61: Discuss the treatment of realized gains from

Q133: Which of the following real property could

Q138: Verdum,Inc.,has a 2011 net § 1231 gain