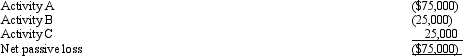

Alex has three passive activities with at-risk amounts in excess of $100,000 for each.During the year,the activities produced the following income (losses) .  Alex's suspended losses are as follows:

Alex's suspended losses are as follows:

Definitions:

Goods

Physical items that are produced for sale on the market, which can satisfy human wants or needs, such as food, clothes, and cars.

Trade

The exchange of goods, services, or both between two or more parties, either within the same country or across international borders.

Different Goods

Variety of products or items that satisfy different needs and wants or provide various forms of utility to consumers.

Double Coincidence

A situation in bartering where two parties each hold an item the other wants, enabling them to exchange these items directly without the need for money.

Q45: Lavender,Inc.,incurs research and experimental expenditures of $210,000

Q49: On January 5,2011,Bill sells his principal residence

Q50: A taxpayer pays points to obtain financing

Q60: Dirk,who uses the cash method of accounting,lives

Q61: Which,if any,of the following is subject to

Q63: Charles owns a business with two separate

Q75: When an individual taxpayer has a net

Q85: In terms of revenue neutrality,comment on a

Q96: In 2011,Glenda had a $97,000 loss on

Q127: An education expense deduction is not allowed