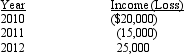

Samantha invested $75,000 in a passive activity several years ago,and on January 1,2010,her amount at risk was $15,000.Her shares of the income and losses in the activity for the next three years are as follows:

How much can Samantha deduct in 2010 and 2011? What is her taxable income from the activity in 2012? (Consider both the at-risk rules as well as the passive loss rules.)

How much can Samantha deduct in 2010 and 2011? What is her taxable income from the activity in 2012? (Consider both the at-risk rules as well as the passive loss rules.)

Definitions:

Burdensome

Describing something that is difficult to carry out or endure; causing hardship or distress.

Socialization

Socialization is the process through which individuals learn and internalize the values, beliefs, and norms of their society or cultural group, gaining the skills and knowledge necessary to function within it.

Heteronormativity

The assumption that heterosexual orientation is the default or normal state of human sexuality, which influences cultural norms and social expectations.

Gender Division

The separation of roles, responsibilities, and opportunities in society based on gender, often leading to inequality.

Q8: Ebon Company had an involuntary conversion on

Q14: In early July 2011,Gavin is audited by

Q16: Jon owns an apartment building in which

Q20: Travel status requires that the taxpayer be

Q31: Luke's itemized deductions in calculating taxable income

Q40: Aaron is a self-employed practical nurse who

Q54: Eunice Jean exchanges land held for investment

Q54: The Federal per diem rates that can

Q103: Stuart is the sole owner and a

Q146: Which,if any,of the following is a typical