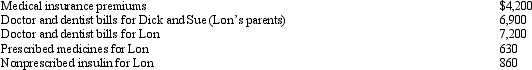

Lon is employed as an accountant.For calendar year 2011,he had AGI of $120,000 and paid the following medical expenses:  Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Definitions:

Intuition

The ability to understand something instinctively, without the need for conscious reasoning.

Reinforcement

Any event that follows a response and strengthens or increases the probability that the response will be repeated.

Geopolitical Position

The strategic importance of a country or region as influenced by its geographic location and political factors in relation to other spaces.

Economic Development

The process by which a nation improves the economic, political, and social well-being of its people.

Q8: Samantha invested $75,000 in a passive activity

Q45: Identify two tax planning techniques that can

Q47: When a nonbusiness casualty loss is spread

Q52: The child tax credit is based on

Q54: The Federal per diem rates that can

Q56: Tired of her 60 mile daily commute,Margaret

Q72: a.Orange Corporation exchanges a warehouse located in

Q86: If an income tax return is not

Q134: The maximum § 1245 depreciation recapture generally

Q139: Regarding tax favored retirement plans for employees