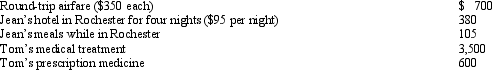

Tom is advised by his family physician that he needs back surgery to correct a problem from his last back surgery.Since Tom is in a wheel chair,he needs his wife,Jean,to accompany him on his trip to Rochester,Minnesota,for in-patient treatment at the Mayo Clinic,which specializes in this type of surgery.Tom incurred the following costs:  Compute Tom's medical expenses for the trip (subject to the 7.5% floor) .

Compute Tom's medical expenses for the trip (subject to the 7.5% floor) .

Definitions:

Training Method

Various techniques or strategies used to transfer knowledge and skills to employees or individuals for their development.

Readiness Training

Training programs designed to prepare individuals for a new role, job, or responsibility, ensuring they possess the necessary skills and knowledge.

Employee Characteristics

Traits, skills, and attributes of individuals that are relevant to their performance and behavior in the workplace.

Case Studies

Detailed examinations or narratives of specific incidents or entities to illustrate specific principles, investigate phenomena, or assess outcomes.

Q26: Charmine,a single taxpayer with no dependents,has already

Q26: Jerry's at-risk amount in a passive activity

Q43: During 2011,Ralph made the following contributions to

Q61: Contributions to public charities in excess of

Q86: In a farming business,MACRS straight-line cost recovery

Q91: Even though a client refuses to correct

Q97: Rental use depreciable real estate held more

Q106: During the year,Oscar travels from Raleigh to

Q110: In a farming business,if the uniform capitalization

Q128: A fixture will be subject to the