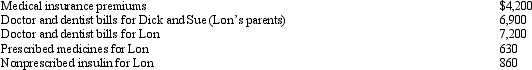

Lon is employed as an accountant.For calendar year 2011,he had AGI of $120,000 and paid the following medical expenses:  Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Definitions:

Complaint Drafting

The process of creating a formal legal document to initiate a lawsuit, outlining the plaintiff's claims against the defendant.

Firm's Library

A collection of books, digital resources, and other informative materials held or used within a law firm or corporation for research purposes.

Caption

The part of a legal document or pleading that shows where a case is filed, the case number, and the parties involved.

Court Assigns Number

The unique numerical identifier given by the court to a case for tracking and reference purposes.

Q2: Renee purchases taxable bonds with a face

Q9: Unlike FICA,FUTA requires that employers comply with

Q13: Qualifying tuition expenses paid from the proceeds

Q16: Daniel just graduated from college.The cost of

Q31: Carol pays the medical expenses of her

Q38: Antiques may be eligible for cost recovery

Q59: Robert sold his ranch which was his

Q78: The civil fraud penalty can entail large

Q106: Taxes levied by all states include:<br>A) Liquor

Q122: Every year,Penguin Corporation gives each employee a