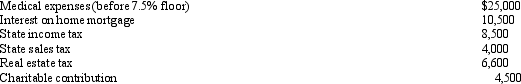

Steven is single and has AGI of $275,300 in 2011.His potential itemized deductions for the year total $59,100 and consist of the following:

What is the amount of itemized deductions Steven may claim?

What is the amount of itemized deductions Steven may claim?

Definitions:

High Demand

Refers to a situation where the need or desire for a product or service exceeds the available supply within the market.

Low Demand

A situation where the desire or market requirement for a product or service is below average or expected levels.

Transportation Costs

The expenses involved in moving goods from one location to another, including fuel, labor, and maintenance of transportation vehicles.

Aggregation

The process of combining multiple units or data points into a single entity or dataset for analysis or reporting purposes.

Q8: In 2012,Mary had the following items: <img

Q26: Dabney and Nancy are married,both gainfully employed,and

Q31: Several years ago,Tom purchased a structure for

Q37: Ken has a $40,000 loss from an

Q57: During the year,Eve (a resident of Billings,Montana)spends

Q70: Recognized gains and losses must be properly

Q72: BlueCo incurs $700,000 during the year to

Q76: Rachel participates 150 hours in Activity A

Q93: The amount of loss for partial destruction

Q100: How are "stealth taxes" justified and how