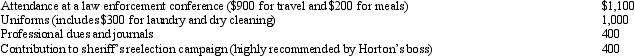

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Definitions:

National Defense

The protection and defense of a nation's sovereignty, territorial integrity, and interests, through the use of military and defense strategies.

Postal Service

A government or private sector service responsible for the collection, transport, and delivery of mail and packages.

State Spending

The amount of money a government spends on public services and goods, including education, healthcare, and infrastructure.

Education

The process of facilitating learning, or the acquisition of knowledge, skills, values, beliefs, and habits through various means.

Q2: Rosie owned stock in Acme Corporation that

Q12: Regarding research and experimental expenditures,which of the

Q38: Discuss the computation of NOL remaining to

Q72: For personal property placed in service in

Q73: Federal excise tax is no longer imposed

Q79: Assuming a taxpayer qualifies for the exclusion

Q80: Discuss the treatment given to suspended passive

Q81: Albie operates an illegal drug-running business and

Q86: In 2011,Roseann makes the following donations to

Q90: Steve has a tentative general business credit