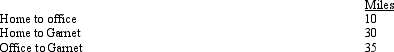

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

Definitions:

Direct Labor Costs

Expenses that can be directly tied to the production of specific goods or services, such as wages of workers.

Indirect Labor

Labor costs not directly associated with the production of goods or services, but rather supporting roles like maintenance and supervision.

Factory Overhead

All indirect costs associated with manufacturing, excluding direct labor and direct materials costs.

Factory Overhead Costs

Indirect manufacturing expenses that are not directly tied to the production of goods, such as utilities, maintenance, and managerial salaries.

Q8: For real property,the ADS convention is the

Q43: During 2011,Ralph made the following contributions to

Q48: Green Company,in the renovation of its building,incurs

Q56: On February 20,2012,Susan paid $200,000 for a

Q56: Bob sold a personal residence to Fred

Q65: If a vacation home is classified as

Q87: A business bad debt can offset an

Q111: For a vacation home to be classified

Q115: For the year 2012,Amber Corporation has taxable

Q135: Walter sells land with an adjusted basis