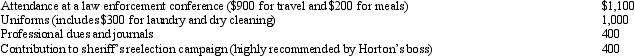

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Definitions:

Mad Cow Disease

A fatal neurodegenerative disease in cattle that can be transmitted to humans, causing a variant of Creutzfeldt-Jakob Disease.

Ground Beef

Beef that has been finely chopped by a meat grinder or a similar tool, often used in cooking various dishes.

Demand Elasticity

An indicator of the responsiveness of the quantity demanded of a product to changes in its price, where an elasticity greater than one signifies heightened sensitivity.

Total Revenue

The total amount of money received by a company from sales of goods or services, before any expenses are subtracted.

Q9: Jena is a full-time undergraduate student at

Q12: Jacqueline is employed as an architect.For calendar

Q17: For state income tax purposes,all states allow

Q20: Albert had a terminal illness which required

Q39: A bond held by an investor that

Q57: Sarah purchased for $100,000 a 10% interest

Q59: On June 1,2012,James places in service a

Q75: Meg's employer carries insurance on its employees

Q87: A business bad debt can offset an

Q114: Rocky has a full-time job as an