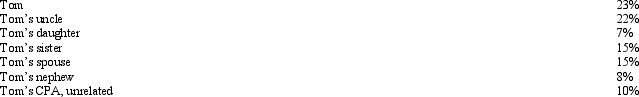

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Definitions:

Traditional Student

A student 18 to 25 years old, usually going from high school directly to college.

Hands-On Experience

Practical experience gained through direct involvement in a task or activity, often as opposed to theoretical knowledge.

Networking Opportunities

Chances to meet and interact with other people in one’s industry or field of interest, often for the purpose of professional advancement.

Financial Assistance

Funds provided to individuals or organizations in need, often for educational purposes, businesses, or personal emergencies.

Q11: If the amount of the insurance recovery

Q16: Taylor,a cash basis architect,rents the building in

Q30: An election to use straight-line under ADS

Q41: Determine the proper tax year for gross

Q58: Mabel is age 65 and lives on

Q76: Amy works as an auditor for a

Q80: Orange Cable TV Company,an accrual basis taxpayer,allows

Q101: In computing the NOL of a corporation,the

Q107: In the computation of a net operating

Q123: In return for a 10% interest in