Multiple Choice

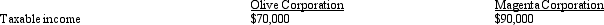

Two unrelated,calendar year C corporations have the following taxable income for the current year:  Magenta Corporation is a qualified personal service corporation.Based on these facts,their corporate tax liability is:

Magenta Corporation is a qualified personal service corporation.Based on these facts,their corporate tax liability is:

Definitions:

Related Questions

Q8: Citron Company is a wholesale distributor of

Q50: Doug and Pattie received the following interest

Q75: Original issue discount is amortized over the

Q84: Taylor had the following transactions for 2012:<br>

Q96: Margaret made a $90,000 interest-free loan to

Q97: Samantha and her son,Brent,are cash basis taxpayers.Samantha

Q107: Generally,a U.S.citizen is required to include in

Q108: Louise works in a foreign branch of

Q125: Under the formula for taxing Social Security

Q146: In 2012,Warren sold his personal use automobile