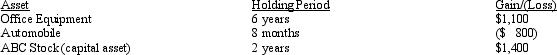

The following assets in Jack's business were sold in 2012:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Self-Focused

Paying excessive attention to oneself, one’s needs, and one's personal experiences, sometimes at the expense of others.

Social Loneliness

A state of feeling disconnected and isolated from a social community or network, even when surrounded by people.

Older Individuals

Refers to people who are in the later stages of their life, typically considered to be of advanced age or elderly.

Friendship

A close and enduring relationship, marked by mutual affection, trust, support, and the enjoyment of each other's company.

Q10: The Multi Department store takes physical inventories

Q25: Harry receives a $10,000 distribution from a

Q41: Alvin is employed by an automobile dealership

Q57: What kinds of property do not qualify

Q64: Which is not considered to be a

Q72: In adjusting the taxable income of a

Q73: For each of the following involuntary conversions,determine

Q77: Which court decision carries more weight?<br>A) Federal

Q93: Changes in the liabilities (trade accounts payable,bank

Q145: On January 1,2012,Copper Corporation (a calendar year