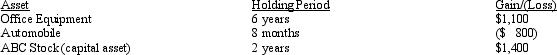

The following assets in Jack's business were sold in 2012:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) ,Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Defence Mechanism

Psychological strategies used unconsciously by individuals to protect themselves from anxiety and to cope with reality or maintain self-image.

Identification

The process of associating oneself closely with other individuals or groups, often by adopting their characteristics or views.

Self-esteem

An individual's subjective evaluation of their own worth or value.

Alliance

A union or association formed for mutual benefit, especially between countries or organizations.

Q21: A taxpayer whose principal residence is destroyed

Q21: If property that has been converted from

Q55: Child and dependent care expenses do not

Q55: Crimson Corporation owns stock in other C

Q90: Maude's parents live in another state and

Q93: A realized loss whose recognition is postponed

Q97: Discuss the treatment of realized gains from

Q110: If the basis of a partnership interest

Q122: The amount received for a utility easement

Q136: The amount realized does not include any