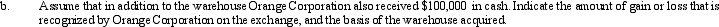

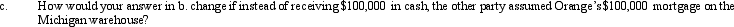

a.Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000)for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Definitions:

Maturity

The state of being fully developed physically or mentally, often associated with adulthood and the ability to respond to the environment in an appropriate manner.

Muscular-anal Stage

In psychoanalytic theory, the muscular-anal stage is part of the psychosexual development stages, focusing on toilet training and the child's ability to control bodily functions.

Adulthood Stage

A period in human development characterized by fully developed physical growth, maturity, and the assumption of adult roles and responsibilities.

Generativity Versus Isolation

A stage in Erik Erikson's theory of psychosocial development where middle-aged adults face the challenge of contributing to the next generation or feeling disconnected and isolated.

Q7: On January 3,1998,Parrot Corporation acquired an office

Q9: An incentive stock option (ISO)plan is considered

Q47: In a nontaxable exchange,recognition is postponed.In a

Q54: The work opportunity tax credit is available

Q63: On September 18,2012,Jerry received land and a

Q70: Which statement is incorrect with respect to

Q77: Discuss the effect of a liability assumption

Q79: Income is not taxed if a taxpayer's

Q93: Use the following data to calculate Diane's

Q118: Stuart owns land with an adjusted basis